Correctly Valuing Startups’ Complex Equity Structures

Stock compensation opens up new challenges from a GAAP (ASC 718) perspective

In my work, I encounter complex equity structures across a range of scenarios and companies. But the most common is stock based compensation for start-up companies. Whether you’re an auditor or a CFO, you need to be aware of when and how to value complex equity structures. The penalties for ignorance can be significant, including qualified or adverse audit opinions.

Stock-based compensation is a great solution for a cash strapped companies that generate most if not all of their cash flow from debt and equity holders. It allows employees to be compensated competitively and aligns their goals with capital holders. While owners and employees can see the “value” of their stock compensation clearly, stock compensation opens up new challenges from a GAAP accounting perspective. ASC 718 governs accounting for stock-based compensation and requires fair value recognition as an expense. Doing so is not always easy to quantify but it impacts financial performance metrics.

When you have two sides of the same valuation coin it begs the question: What’s it worth? The answer must be coherent, well-documented, and quantifiable. Otherwise, the company and its stakeholders can face serious consequences.

Defining “complex” equity: a real-world example

A complex equity structure is one that has more than one class of equity with divergent rights, specifically distribution rights. So, what makes complex equity value different from simple equity value?

Let’s take a look at XYZ Co., which is capitalized with 100 common units outstanding. Assume we agree on a reasonable market value of $100 for aggregate equity in XYZ Co. Therefore, we can conclude a fair value per common unit of $1 ($100/100 and ignoring any issues of control or marketability). Simple, right?

But suppose in addition to the outstanding common units, the company also has 100 preferred units with a $100 liquidation preference, which has a 0% preferred return (i.e., the liquidation preference will always be $100), and are non-participating (i.e., they do not participate in distributions beyond their preference.

When we approach the same exercise of computing the fair value per common unit, we run into a problem. Are the common units worth $0 (($100 - $100)/100)? And, if the liquidation preference is greater than or equal to the aggregate value of equity, then how do we assign a value to the common units?

As a holder of a common unit would you take a dollar to sell me your share? Now suppose the preference was $101 and we computed, in the same manner, a price per common unit of ($0.01). Would I be committing an act of charity by taking that common unit off your hands for free? That’s why this model for allocating equity value can be problematic.

So, we need a new paradigm to quantify the value of these securities. Instead of viewing XYZ Co.’s preferred and common units as stock, we can consider them call options on equity value across various distribution tranches. This view is the contingent claims analysis ( “CCA”) and utilizes the Black Scholes Options Pricing Model (“BSOPM”) and call option spreads.

If you’re not familiar with the CCA, then you may know its variant, the Backsolve Method, which uses the same structure but solves for equity value backwards from a security value.

The Contingent Claims Analysis

In the context of the CCA, we are describing the common units as a call on equity, so the stock price is the value of equity. Strike price is the most confusing application in the CCA. Our common units aren’t options, so they don’t have a strike price. Let’s think about the strike price in a traditional option. During the life of an option, the strike price is the price that the current stock price must exceed to entice a rational investor to execute the call. If the stock price never exceeds the strike price over the life of the option, a rational investor would never execute the strike. That’s because the same investor could go out and purchase the same security at the stock price in an open market. Conversely, if the strike is less than the stock price, they could execute the option and resell the security at the higher stock price and walk away with the net in cash. Simply, the strike price is the threshold at which the option holder would receive a distribution.

The term (time) should match the best estimate of the length of time until a liquidity event occurs. Since BSOPM is logarithmic, the longer the term, the less variance there is to affect the call option value. We might use the volatility of comparable public companies as a proxy for our subject private company.

Domestically, the risk-free rate (“RFR”) is based on U.S. Treasury bond yields. In a CCA, the dividend rate should always be 0% to prevent an issue called “leakage” in which the aggregate value of individual securities is less than the total value of equity.

Applying CCA

With this new understanding, let’s revisit the fair value of a common unit of XYZ Co. and express it as a call option. To accomplish this, we need to estimate our six variables. Our stock price is the value of equity or $100. Strike price is where the common units walk away with cash. In a transaction, the first $100 would be distributed to preferred unit holders, but everything in excess would go to common units. So, our strike price is $100.

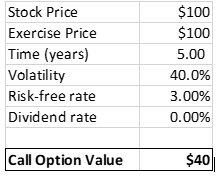

Having talked to management and studied comparable companies, I know the term is five years, volatility is 40%, RFR is 3%, and dividend rate is 0%. Putting these six inputs into the BSOPM results in the following:

There are aggregate common units, so the fair value of a single unit is $0.40. Let’s remember what brought us down this path. We had a methodology that provided a logical answer for our simple structure, but not for our complex structure. Now, we have a methodology that provides a logical answer for our complex structure, but what about our simple structure?

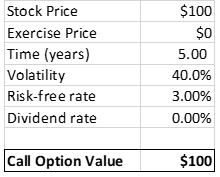

In our example of XYZ Co., in which the common units are the only class of stock, all of our inputs are the same, except for strike price. The common units receive distributions above $0. If we input that into our BSOPM, we get the following:

Dividing this call option value for all common units results in a fair value per common unit of $1. Now, we have a paradigm that addresses simple AND complex equity structures. This also illuminates the relationship between strike price and call option value. If we chart this relationship, we end up with the following:

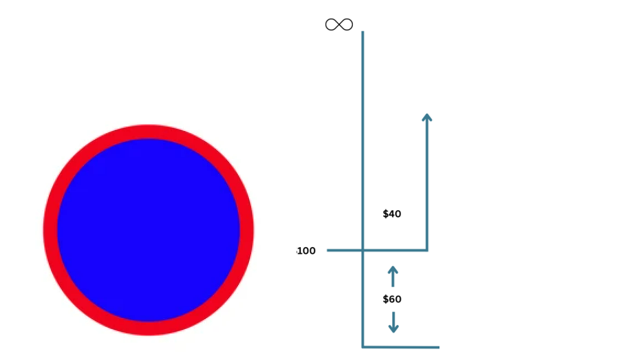

Here we see how our logarithmic equation makes sense. As the strike price increases, the risk adjusted value of the option decreases. We’ve now isolated a mechanism to define values into strata by distribution threshold. There are two ways to apply this tool:

1) Positively define an area as we did with the common units in our complex equity structure to find that the aggregate common units have a $40 value.

2) Negatively define a space. How do we calculate the fair value per preferred unit? In the chart below, if I drew the blue circle inside the red circle, you might be challenged to tell me what the area of the red space is. We don’t have a convenient formula to calculate the area of a donut and we don’t have a convenient formula to calculate the value of distributions of up to $100 for XYZ Co. However, if I gave you the radius of the red and blue circles, you could calculate the area of the red circle less the blue circle and thus, calculate the area of the red space. We know that the values of a call option on XYZ Co. with a strike price of $0 and $100 are $100 and $40, respectively. Using our geometry, we can calculate the fair value of a preferred unit to be $0.60 (($100 - $40) / 100). This is referred to as a call option spread and is illustrated below.

The CCA is a pragmatic, expedient, and well accepted methodology to allocate value across the structure. It inherently accounts for differentials in risk and reward structures between equity classes. While CCA is not the only methodology for making the above calculation, it requires significantly fewer inputs and is less sensitive to company specific assumptions.

Conclusion

Overall, CCA presents a particularly strong option for a start-up company trying to account for incentive stock compensation and without creating significant risk exposure on its financial statements (ASC 718). Contact me any time to discuss.

Anthony Venette, CPA/ABV is a Senior Manager, Business Valuation & Advisory, DeJoy & Co., CPAs & Advisors in Rochester, New York. He provides business valuation and advisory services to corporate and individual clients of DeJoy.