New Accounting Standards Upcoming Effective Dates for Public and Private Companies

This publication summarizes the new accounting standards with mandatory[1] effective dates in the first quarter of 2024 for public entities, as well as new standards that take effect in annual 2023 financial statements for nonpublic entities. Those effective dates reflect the deferral of certain major standards provided in ASU 2019-10.

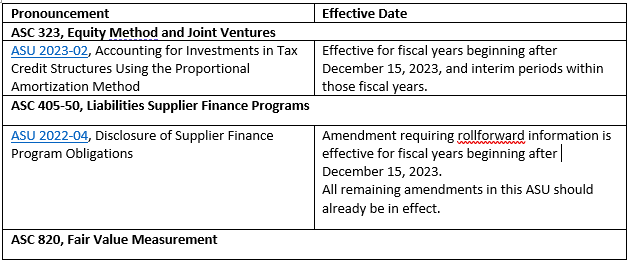

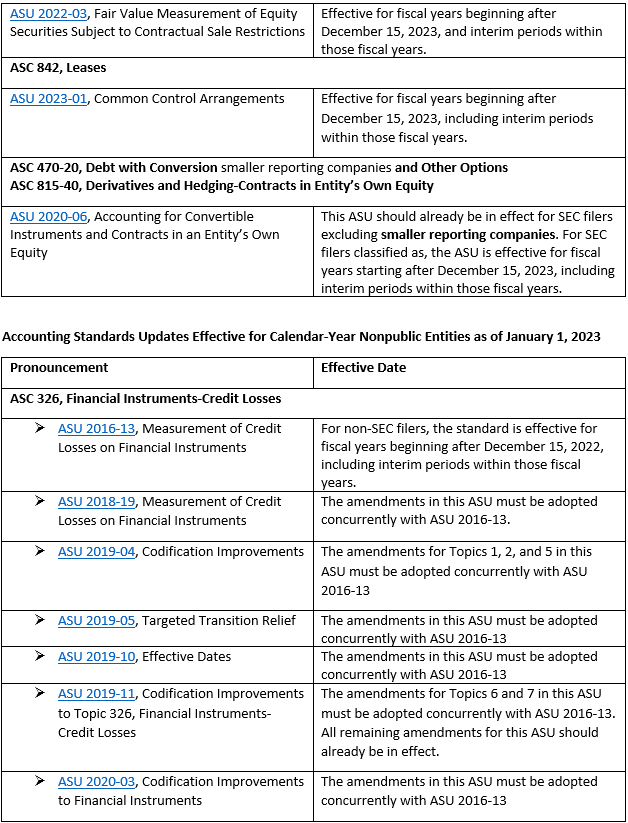

In the next filing season, calendar year-end public entities will prepare their annual 2023 financial statements, followed closely by their March 31, 2024, first quarter reports. Under SAB 74, entities will disclose in their 2023 annual filings the expected impact of adopting the FASB’s new standards on their financial statements. Standards issued after this publication’s date are unlikely to affect first-quarter financial statements, but entities consider them in preparing SAB 74 disclosures. For many public entities, the most significant first quarter change will be adoption of recent changes to equity securities subject to contractual sale restrictions.[2]

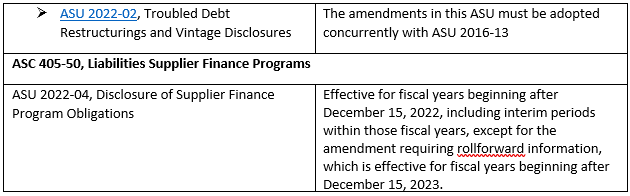

On a similar timeline, calendar year-end nonpublic entities will prepare their annual 2023 financial statements reflecting standards that took effect in 2023. Nonpublic entities that report on a calendar year adopt the credit losses[3] standard effective January 1, 2023, for a calendar year-end reporting date as of December 31, 2023.

Early adoption is generally permitted for all standards summarized herein, but each ASU has specific transition guidance, and early adoption may have been limited to certain periods or circumstances.

Accounting Standards Updates Effective for Calendar-Year Public Entities as of January 1, 2024

Your DeJoy & Co. representative is there to assist you in navigating these changes and implementing best practices.

Gregory O’Leary is a Principal, Financial Assurance Services, DeJoy & Co., CPAs & Advisors in Rochester, New York. He provides assurance and financial reporting services to DeJoy’s clients in a variety of industries.