FASB Finalizes ASU to Disaggregate Income Statement Expenses

Summary

Based on investor and other constituent feedback requests for more information about income statement expenses, the Financial Accounting Standards Board (FASB) introduced guidance requiring expanded disclosures for public business entities (as defined in U.S. GAAP) about specific income statement expenses in Accounting Standards Update (ASU) No. 2024-03: Income Statement — Reporting Comprehensive Income — Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses.

This Bulletin summarizes the ASU, including the new disclosure requirements and effective dates. This ASU does not change income statement presentation requirements but instead expands the disclosure requirements for specific costs and expenses.

Background

The ASU’s primary goal is to provide greater transparency about the components of specific expense categories in the income statement. Before this ASU, Accounting Standards Codification (ASC) Topic 220, Income Statement — Reporting Comprehensive Income, did not require separate presentation of specific expense captions unless required by industry-specific guidance or upon a triggering event (such as a goodwill impairment).

In finalizing the ASU, the FASB affirmed many of the positions set forth in its July 2023 proposal, while also incorporating stakeholder feedback.

Main Provisions

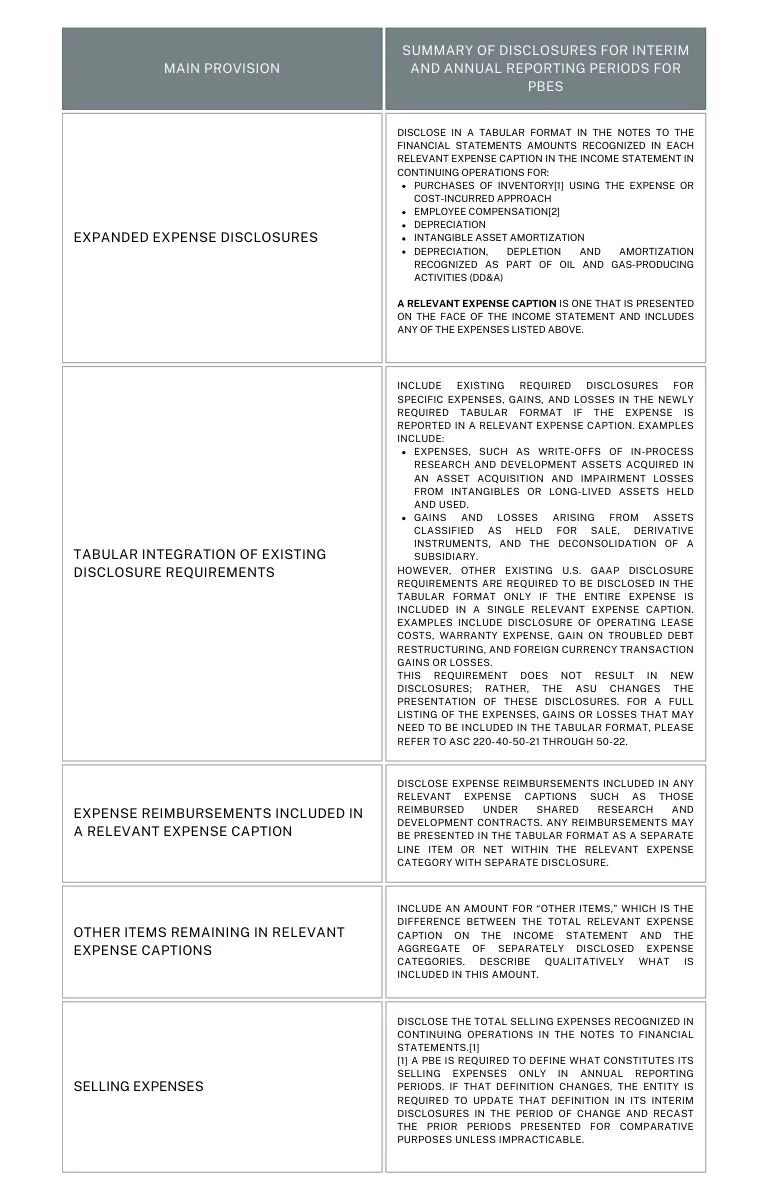

This ASU requires public business entities (PBEs) to provide expanded disclosures about specific expense categories in interim and annual reporting periods, as summarized below:

A PBE also may provide voluntary disclosures in the tabular format to offer investors decision-useful information, if that information is not combined with the required, disaggregated disclosures.

The disclosure requirements must be applied consistently across all periods presented. If the PBE alters its display of these requirements because of a change in the election of an alternative or a change in the definition of a disclosure, the PBE must:

Disclose the reason for the change.

Recast the prior periods presented for comparative purposes, unless impracticable. If it is impracticable to recast the prior periods, the entity must also explain why.

Analyze the Disclosure Requirements and Adjust Recordkeeping and Estimation Processes

Producing the information necessary to comply with the new disaggregated expenses disclosure may require detailed recordkeeping. The FASB acknowledged that this process may be challenging for some entities if their financial reporting systems do not currently track information using the categories required by the ASU. Therefore, the ASU explicitly allows entities to use estimates or other methods that reasonably approximate the required disclosure amounts. Nonetheless, updating recordkeeping and estimation processes may require significant time, and PBEs should begin the implementation process as soon as possible.

The Appendix provides examples of these new, disaggregated disclosure requirements.

Effective Dates and Transition

The following table summarizes the effective dates and transition for the ASU for public business entities:

Read the full ASU 2024-03.

[1] As a practical expedient, when substantially all of a PBE’s expense caption is based on purchases of inventory (excluding any amounts recognized from a business combination, joint venture formation or initial consolidation of a variable interest entity), the entity may elect to quantitatively describe the make-up of the expense caption in interim and annual reporting periods rather than providing the required quantitative disclosures.

[2] As a practical expedient, a PBE that presents an expense caption for salaries and employee benefits on the face of its financial statement in accordance with ASC 942-330-S99-1 may use those amounts to comply with this ASU.

[3] A PBE is required to define what constitutes its selling expenses only in annual reporting periods. If that definition changes, the entity is required to update that definition in its interim disclosures in the period of change and recast the prior periods presented for comparative purposes unless impracticable.

Written by Angela Newell and Adam Brown. Copyright © 2024 BDO USA, P.C. All rights reserved. www.bdo.com