Key Accounting Considerations Leading Into Your Year-End Audit

Year-end audits may be conducted for a host of reasons, including investor requirements and regulatory compliance. While all accounting matters are important to an audit, this article explores essential considerations that may be overlooked or misunderstood, leading into audit season for most companies: lease modifications and remeasurements, new segment disclosures, goodwill and intangible impairment considerations, as well as the measurement of credit losses covered by FASB Topic 326.

Lease Modifications and Remeasurements

A lease modification occurs when a change to the terms and conditions of a contract results in a change in the lease’s scope or consideration. For example, a lease amendment to effectuate the exercise of a renewal option contained in the original lease generally does not constitute a modification. In contrast, an amendment to extend the lease term by adding a renewal option to the lease term, or adding additional space to the leased premises, would require further analysis under the lease modification guidance.

When preparing for a year-end audit, it is necessary to have a good understanding of how the lease modification guidance works under ASC 842. While lease software solutions often offer the ability to modify leases, a lack of understanding of the complexities of the lease modification guidance can result in errors as accounting teams mistakenly conclude that a lease meets the modification criteria. Modifications to leases require careful consideration to ensure proper accounting treatment under ASC 842:

Effective Date: Under ASC 842, the effective date of a lease modification is the date when both parties agree to the changes. Lessees and lessors are required to account for modifications on the effective date.

Differentiation between Separate and Non-Separated Contracts: A lease modification is accounted for as a separate contract if the modification grants the lessee an additional right-of-use asset that was not part of the original lease and the increase in lease payments is commensurate with the additional right of use’s standalone price. A modification that is accounted for as a separate contract does not affect the accounting for the original contract.

A lease modification that is not accounted for as a separate contract is accounted for like a new lease. The lessee reassesses the lease classification and remeasures the right-of-use-asset and the lease liability based on the changed terms of the modified contract (including the changed lease payments).

If a lease is fully or partially terminated, the lessee decreases the carrying amount of the ROU asset on a basis proportionate to the full or partial termination. Any difference between the reduction in the lease liability and a proportionate reduction in the ROU asset is recognized as a gain or loss at the effective date. This guidance applies only if the right of use ceases immediately at the effective date. If a termination is delayed or conditional, the lessee recognizes the remeasurement amount of the lease liability as an adjustment to the right-of-use asset, consistent with the guidance for a lease term reduction.

Facts and circumstances may change over the course of the lease term that can affect assumptions initially made when measuring leases at inception. In addition to a change in the consideration or space used, changes in assumptions from the initial lease measurement can result in a remeasurement event.

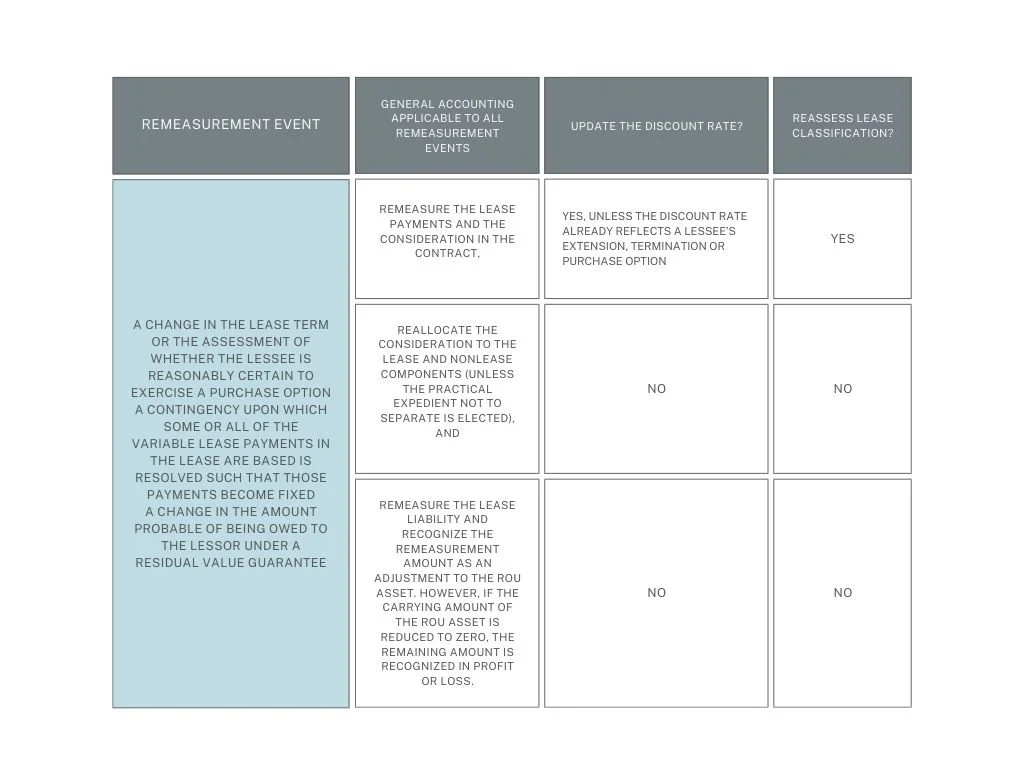

The following table illustrates events that require a lessee to remeasure a lease.

It is important to highlight that the requirement for a remeasurement event may not be initially apparent as compared to a contractual lease modification as there are no changes to the lease contract, but rather the assumptions used to measure the lease. Business decisions made outside of accounting are likely to impact the factors that can trigger a remeasurement event. These decisions can include:

significant leasehold improvements that may indicate a likely extension of lease term renewal.

changes in subleasing activity (e.g., a decision to partially or fully sublet an active lease or extending a sublease beyond the original head lease term).

changes in the use of the leased asset (e.g., change in the comparable utilization of the lease).

Understanding the corroborating factors that may result in a reconsideration event is critical to determining if such an event has occurred.

New Segment Disclosures

Effective for fiscal years beginning after December 15, 2023, public companies must adhere to Accounting Standards Update 2023-07—Segment Reporting (Topic 280)—Improvements to Reportable Segment Disclosures. This guidance introduced significant changes to segment disclosures for public entities. ASU 2023-07 requires that public entities, including those with single reportable segments, disclose the following:

Significant segment expenses for each reportable segment.

Other segment items for each reportable segment, including a description of such items. The other segment items category is the difference between segment revenue less the segment expenses disclosed under the significant expense principle and each reported measure of segment profit or loss.

Title and position of the individual or the name of the group or committee identified as the chief operating decision maker (CODM).

Explanation of how the CODM uses the disclosed measure(s) of segment profit or loss.

Also, entities must now provide most of the existing annual disclosures in interim periods. That includes reconciling each measure of segment profit or loss to the consolidated income statement on an interim basis. However, an entity is not required to reconcile a segment’s total assets to consolidated assets or a segment’s revenues to consolidated revenues.

Stakeholders can gain a clear view of resource allocation and usage across different segments of the organization, including breakdowns of expenses that could significantly affect segment performance.

Impairment Considerations

For most companies, preparing for year-end audits includes annual impairment testing for goodwill and indefinite-lived intangible assets. Companies that have elected the Private Company Council (PCC) alternatives provided by the Financial Accounting Standards Board (FASB) to amortize goodwill are required to conduct a goodwill impairment test only when a triggering event is present. Similarly, if a triggering event occurs, an entity may also need to test other long-lived assets for impairment. Impairment assessments can be complex and time consuming. Failing to assess impairment in a timely manner can lead to unexpected audit delays.

Impairment of Goodwill and Indefinite-Lived Intangibles

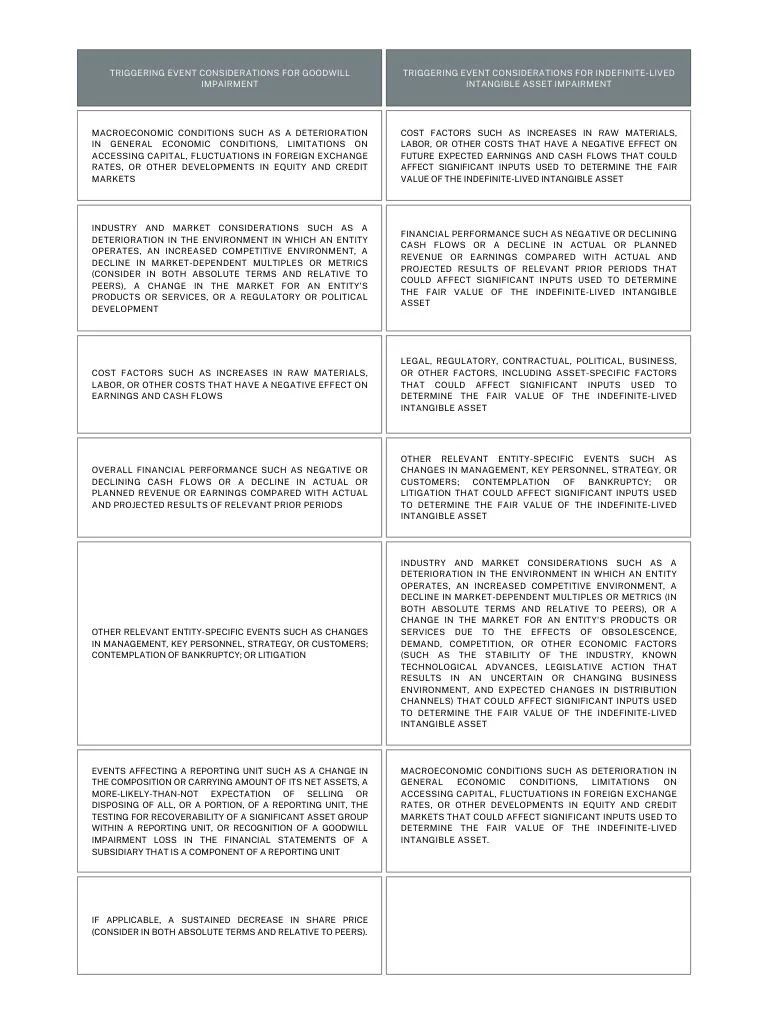

ASC 350, which deals with the impairment of goodwill and indefinite-lived intangible assets, lists the following common triggering events (which are not all inclusive):

For private entities that have elected to follow the PPC alternative for goodwill, the presence of one or more of these triggers requires further assessment to determine if goodwill is impaired. Public companies or other entities that do not follow the PCC alternative for goodwill are required to test for goodwill at least annually, regardless of whether a triggering event has occurred.

FASB Topic 326, Financial Instruments – Credit Losses (CECL)

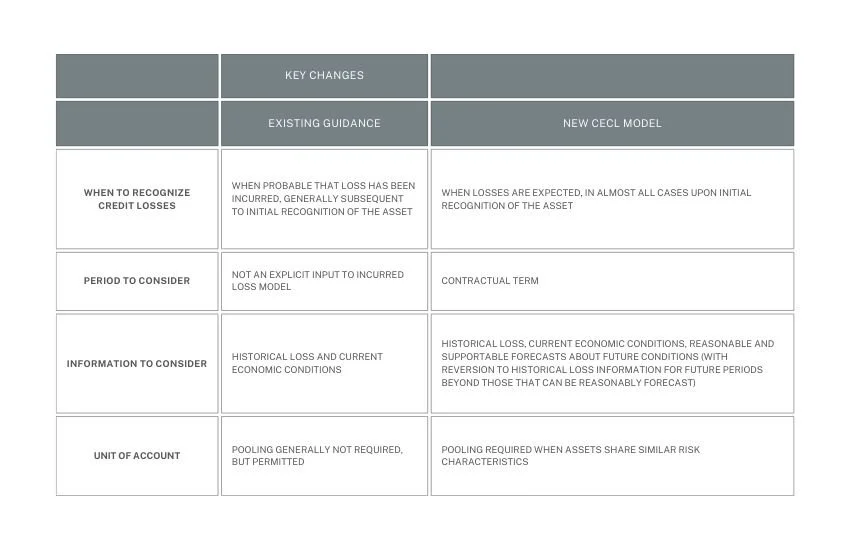

The Current Expected Credit Loss (CECL) model under FASB Topic 326 significantly changed how companies account for expected credit losses. The ASU requires that credit losses on most financial assets carried at amortized cost, as well as certain other instruments, be measured using an expected credit loss model (referred to as the CECL model). Under this model, entities will estimate credit losses over the entire “contractual term” of the instrument (i.e., considering estimated prepayments, but not expected extensions or modifications unless a reasonable expectation of a troubled debt restructuring exists) from the date of initial recognition of that instrument. The initial measurement of expected credit losses, as well as any subsequent change in the estimate of expected credit losses, is recorded as a credit loss expense (or reversal) in the current period income statement. The objective of CECL is to provide financial statement users with an estimate of the net amount the entity expects to collect on those assets.

When measuring credit losses under CECL, financial assets that share similar risk characteristics (e.g., risk rating, effective interest rate, type, size, term, geographical location, vintage, etc.) should be evaluated on a collective (pool) basis, while financial assets that do not have similar risk characteristics must be evaluated individually.[2] The ASU provides an indicative list of risk characteristics, which includes both credit and non-credit related characteristics. The ASU indicates that financial assets can be aggregated into pools based on any one or a combination of risk characteristics. However, in practice, it is expected that some credit-related characteristic would be considered. Further, the ASU does not prescribe a specific methodology for measuring the allowance for expected credit losses. For example, an entity may use discounted cash flow methods, loss-rate methods, roll-rate methods, probability-of-default methods, or methods that utilize an aging schedule.

Key changes from existing guidance to the new CECL model are summarized below:

You can learn more about CECL by reading CECL for Non-Financial Institutions.

Approaching year-end audits with a robust understanding of economic indicators and a systematic approach to estimating credit losses can help improve other areas of accounting and financial reporting.

Year-End Audits Are a Yearlong Exercise

Our professionals are available to assist your company in preparing for a smoother year-end audit process by addressing potential risks throughout the year.

Written by Matthew Coker and Justin Ortego. Copyright © 2024 BDO USA, P.C. All rights reserved. www.bdo.com